Hidden Costs of Used Houses

Like used cars, used houses can sometimes seem like a better deal. And like used cars, used houses are often billed as “as good as new.” But like used cars, used houses typically come with hidden costs and unforeseen problems.

The three hidden costs in used houses are:

- Antiquated Design

- Deferred Maintenance

- Monthly Utility Bills

Antiquated Design

When you walk through a used house you’re thinking about fitting your lifestyle into the floor plan. Will it…

- Entertain the way you want to?

- Offer Flexible Living or allow you to use certain areas for multiple things?

- Help you organize your life through Convenient Storage areas?

- Give you the peace and calming at the end of a hectic day through specific areas of De-stressing?

I’m sure you already know this but the perfect floor plan built in your ideal location in the price range you’re looking in doesn’t exist. So, buying a used house is all about compromise. And the single biggest area you’re going to compromise on is the design of the home. Remember, the houses you’re looking at were built for somebody else in a different period of time. Parlors and formal living rooms are no longer the rage!

The design/build remodeling industry today exists for two reasons. First, people who buy a used house and compromise on the design, only to find after compromising for a certain time period of time the design ‘just won’t work’ for them. Second, people who live in the same home for a very long time and their lifestyle have changed but their home’s design hasn’t.

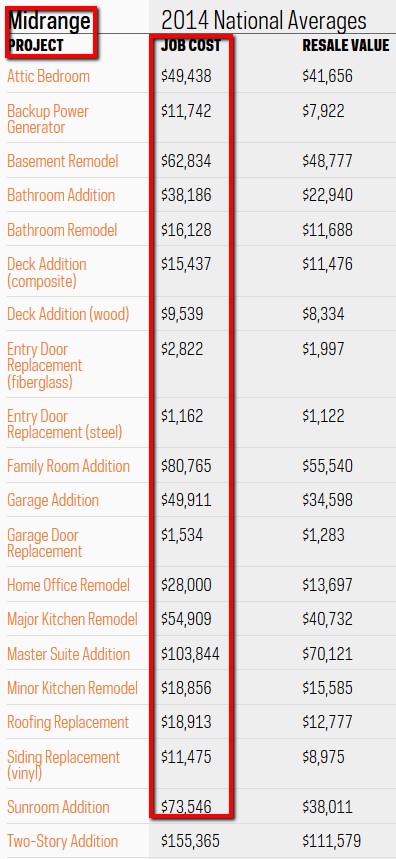

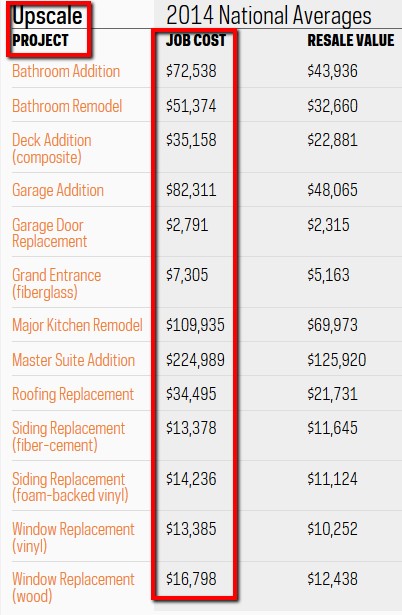

There is a company called Hanley Wood that tracks 35 different type of remodeling projects around the country and rolls all the data into a searchable report. You can see national averages along with sample remodeling costs for your region. Below is a sample chart from 2014 and you can use this link to find the most up-to-date information in your area .

Deferred Maintenance

Roofs leak. Kitchen appliances give out. An older home demands an average of 2-3% of its purchase price for annual upkeep — and that list can be never-ending.

Every component in a house has a usable life. When you buy a used house you’re buying the pro-rated life of each component (e.g. a furnace with a 10 year life expectancy).

Some costs associated with the normal “wear and tear” of an older house are listed below.

Used House Deferred Maintenance Items (partial list) |

|

If you’ve owned a used house before you know the list goes on and on from there.

Energy Costs

There’s no way I can give you exact numbers on how much higher your energy bills will be with a used house. But, here’s why you’ll pay more each month in a used house when it comes to writing that check to the utility company.

Electricity: Today’s light fixtures are designed for CFL bulbs and you’ll have the ability to completely outfit your home with CFL, LED or Halogen bulbs. Any of these options will save you dollars on your electric bill.

Heating Ventilation Air Conditioning (HVAC) systems all use fans to circulate air in your home. Today’s systems use dramatically less energy to turn all these fans saving you more dollars.

Water: All of today’s plumbing fixtures including shower, sink and toilets are designed to use less water and save you money. Landscape irrigation systems are designed with sensors to shut off watering times if the soil around your home has just been watered by Mother Nature.

Natural gas or Propane: Forced air furnaces and boilers are required to be 90%+ efficiency. These appliances not only keep more of your money in your pocket, they also provide better heating when combined with the correct ducting ventilation.

When you add…

- Remodeling costs

- Deferred maintenance

- Higher utility costs…

…to your monthly mortgage payment (after taxes), your costs are often substantially higher with a used house than with the purchase of a comparably sized new home. And with a brand new home, you can build your dream – not inherit someone else’s problems.